plan. / your personal investment regulations

Those who have investment regulations are better positioned in the current crisis. At the latest now, it is time to plan for the future with personal investment regulations.

Only those who know what he / she wants will get the right services! Today, however, only 7% of wealthy private individuals have an investment regulations documented in any form.

Why do you need investment regulations?

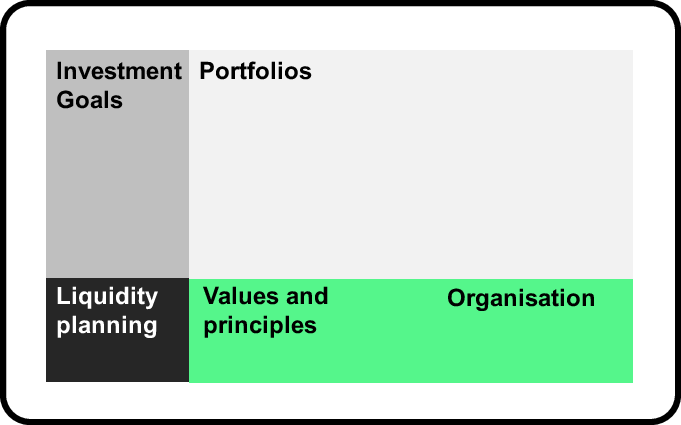

The investment regulations are the basis for your wealth management. Once defined, it helps to formulate the orders to banks and asset managers precisely and equips you with a a comprehensive and easy to understand overview. It also provides the basis for the assessment the results later on. And last but not least, it is useful for all decisions and helps the all involved people (e.g. your family) to get an overview of your wealth management when needed.

This is how it works

We develop and manage your personal investment regulations. Now you know exactly what to expect from your banks and asset managers.

- In a workshop, we work out the specific requirements with you

- A planning team will work out options for the portfolio architecture for your wealth

- The results are summarized as personal investment regulations and maintained on an ongoing basis

Why with ZWEI Wealth?

No matter which banks and asset managers you work with or whether you make a change, the investment regulations as the foundation of your wealth management remain unaffected. ZWEI Wealth has therefore developed a system that allows you to maintain your own investment regulations independently of banks and asset managers. This is unique and strengthens your position sustainably. Now you know more than the banks and determine the requirements in your sense.