Wealth managers can be distinguished

'Past performance is no guarantee of future results'. Does this standard asset manager disclaimer imply that past results do not contain information related to the future? And does this therefore mean that it is impossible to distinguish the good asset managers from the bad ones in advance? We know for sure: yes, it is indeed possible to distinguish and identify the good asset managers from the bad ones in advance.

The past and present certainly provide valuable information for the future. It is just important to approach the matter realistically. Those who try to find the best asset manager for the next few years will most certainly fail miserably. But those who try to find one of the good ones and thus avoid the bad ones have a good chance of achieving satisfying results.

With the approach developed by ZWEI for the selection of asset managers, we take the past into ac- count when selecting asset managers. Importantly, however, we remain true to our premise: There is very little we know. But the little we know is very powerful. In this sense, we do not rely on forecasts by asset managers regarding their future returns, nor on their back testing. The analysis of how the results (return and risk) of asset managers have moved in the past during different market situations, however, provides valuable insights into the future. The same applies to the cost structure. If the asset manager's fee structure has been high, the future results can be expected to be negatively affected.

As a result, the ZWEI approach identifies those asset managers with a clean and transparent working approach. Excluding unsuitable managers and solutions is almost more important than trying to forecast which asset manager will be the best performing one in the future.

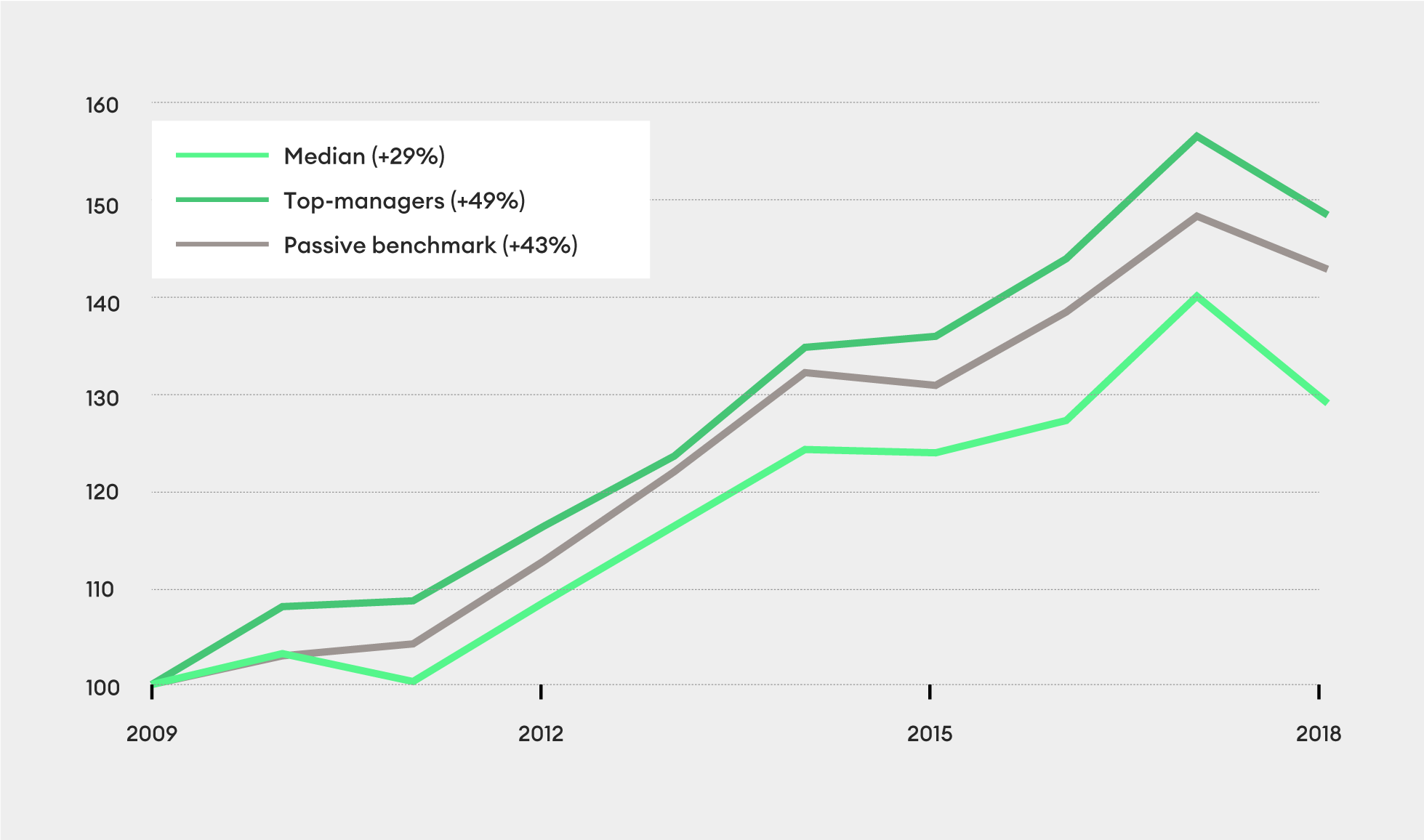

We have been applying this approach since 2014 and are continuously developing it further with the newest date available. The results confirm the approach (see table: where we compared Swiss franc portfolios). In the depicted example, we compared the results of managers selected by ZWEI and their balanced Swiss franc portfolios with the market. In the period from 2010 to 2018, the average of the ZWEI-selection of asset managers (top managers) clearly exceeded the median. Although the top man- agers also outperform the benchmark (after costs), we are more cautious with this result and would not describe it as significant.

Conclusion: We are convinced that the good can be distinguished from the bad. We have provided proof of this for the first time in recent years and will continue to contribute towards better services for you.

Patrick Müller

CEO, ZWEI Wealth Experts