Knowledge: Bitcoin – not irrational, but speculative

The Bitcoin's performance in recent weeks and months has been enormous. Are there good reasons for this development or is it simply a bubble? (pm)

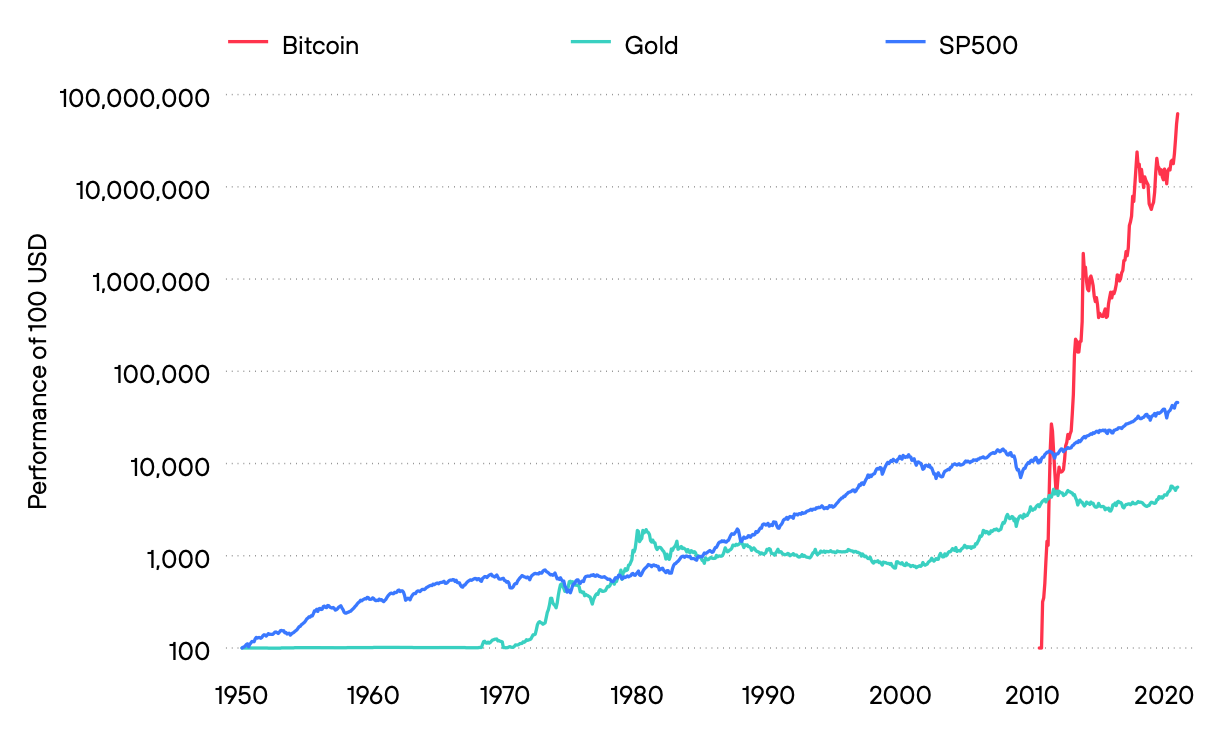

If you invested 100 US dollars (USD) in the American stock market in 1950, you would today have a fortune of a good 600,000 USD. An investment in gold would have yielded about USD 6,000 in the same scenario. In the case of Bitcoin, an investment of USD 100 since 2010 would have risen in value to USD 60 million today.

This thought experiment shows the dimension of the increase. But what is the basis for this enormous growth in value? And perhaps more importantly, will it continue in the future? First, the price increase in bitcoin is not simply an irrationality. To say so would fall short of a well-grounded assessment. Somewhat simplified, one may rather say that today's central bank policy (enormous amounts of money are printed) has meanwhile reached a level of irrationality that lays the rational foundation for the Bitcoin. Because these vast amounts of new money are a danger, it is actually quite rational to consider alternatives to traditional money. Bitcoin is one possible alternative, and because the amount of Bitcoin is finite, the more the irrationality of traditional money increases, the more the Bitcoin's value increases.

So far so good. But of course there are dangers for the future development of Bitcoin's value. For example, the Bitcoin could face competition from the emergence of a state-owned alternative or, for some reason, trust in the Bitcoin could erode. Because a lot of expectations are reflected in the price of the Bitcoin, it will probably continue to fluctuate very strongly in the future. It should not come as a surprise if the price halves again.

Conclusion: There are definitely rational reasons to invest in Bitcoin. However, this investment still requires strong nerves and is built on expectations that can also turn quickly. Gold can be a less nerve-racking option.