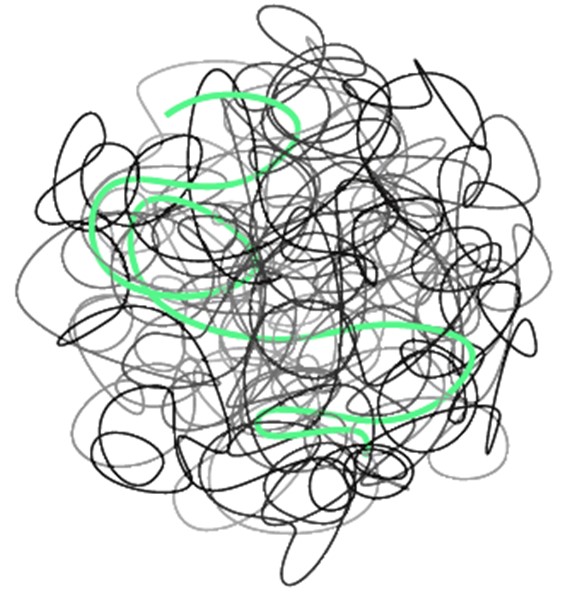

TRANSPARENCY REPORT 2023: The Private Banking Chaos

Once a year, ZWEI Wealth analyzes the wealth management services from the customer's point of view and summarizes the results in a transparency report. The overall impression is very sobering for the industry: we observe a growing chaos for customers. Analyzes and background reports help to classify and provide answers to the most important customer questions.

Wealth management is an important aspect of life planning for which most people are happy to rely on specialists. It is therefore all the more important that customers can rely on good services in this area. With the transparency report, we aim to shed light on asset management every year in the interests of our customers and to make a contribution to further professionalization with more competition and better comparability.

Overview of the most important findings

Here's a quick recap of the key findings from this year's report:

- The Private Banking Chaos: The disorientation of customers in private banking has reached a new high. This deterioration in satisfaction leads to a significantly increased willingness to switch to new models and other providers.

- New Service Models: The Family/Wealth Office service model is gaining ground among a broader group of wealth management customers, leading to significant shifts in weighting..

- Clients compare much more: The willingness of customers to compare offers has increased massively in the last two years. A real culture change is underway here.

- Simple is the better investment mix: The evaluations of the investment strategies of the best portfolio managers show a clear picture. These use a relatively simple investment mix compared to the industry average.

- The Provider Rating as a quality label: In order to be able to offer even better orientation in this chaos, ZWEI Wealth established the provider rating as a seal of quality. We are thus creating a standard that enables all customers to find their way around easily.

- Half the costs: The analysis of the 'fair' market prices shows that the total costs in wealth management are half as high as they are today.

More transparency and competition leads to better performance. This also applies to wealth management.

Patrick Müller, CEO ZWEI Wealth

Order the entire transparency report for free: here

|