58% of private investors do not receive sufficient transparency on results and costs

It is futile to talk about the conflicts of interest of banks and asset managers. The misconduct of the last decades (e.g. retrocessions) has brought the issue to the attention of all parties involved and led to a flood of new regulations. But where does asset management stand today? Have more professional and transparent structures been introduced for clients and providers? No. ZWEI Wealth's analysis shows that there is still much to be done in terms of structures and governance.

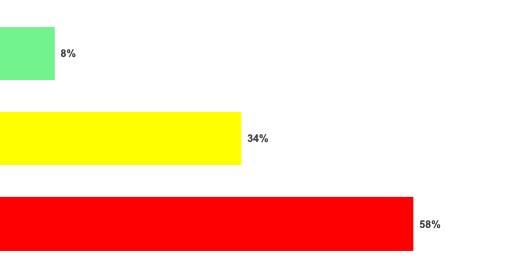

Only 8% have a formalised governance

The chart summarises the results of the analysis. Only 8% of private investors today have a complete and formalised governance model. In 34% of the cases, elements of a governance model have been implemented to some extent. In this group, for example, several similar portfolios at different banks and asset managers serve as benchmarks. In 58% of the cases, there are still hardly any aspects of control mechanisms established.

Banks and asset managers cannot monitor themselves

Of course, there is little incentive on the part of providers to encourage independent governance for their clients. In practice, the independent investment committee has proven to achieve good results and has established itself as the best possible protection of client interests.