The four economic seasons

Surely the swimwear in your wardrobe will soon make way for coats and jumpers again. The season is about to change and we are adjusting accordingly. A change of season is also on the horizon on the financial markets. In technical jargon, this is called a regime change. Here is a brief explanation of the four seasons in the financial markets.

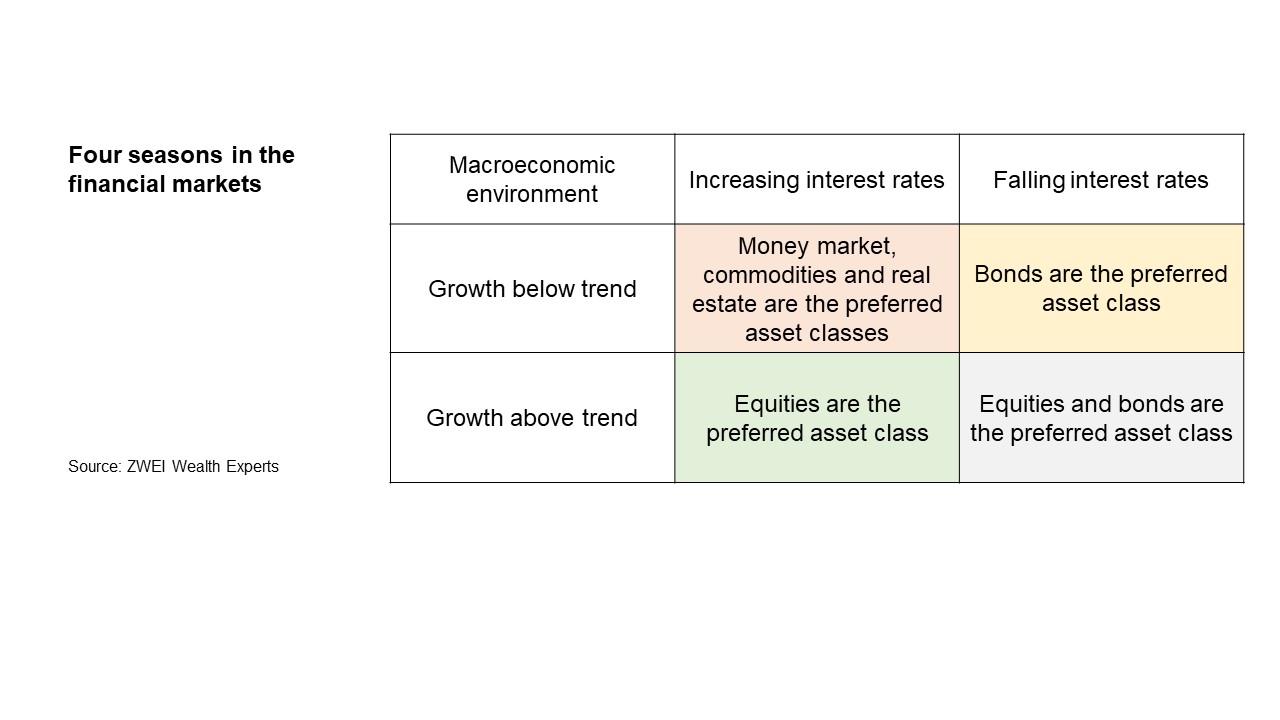

The climatic conditions of financial markets can be simplified to two dimensions: Growth and interest rates. Both can have a tendency to rise or fall. This results in four different scenarios or exactly, «seasons».

Growth and interest rates

Economic growth is one of the central influencing factors. Simplified, one can distinguish between two phases of economic growth by measuring effective economic growth against long-term trend growth. If economic growth is expected to be above trend, this means that weather conditions are basically improving, for example for businesses. The same is true for interest rates: Falling interest rates improve the valuation of companies and bonds. When interest rates rise, the opposite effect can be observed.

Four quadrants

The chart below summarises the four possible combinations of growth and interest rate trends and lists in a simplified way which asset classes perform best in which 'season'. In an environment of falling interest rates and below-trend growth, for example, bonds are preferable because they become more expensive when interest rates fall, while equities tend to underperform when growth is weak. So far so simple. The four quadrants provide a basic understanding of why certain prices tend to rise or fall. In recent years, for example, expectations for good growth have been rising steadily in the aftermath of the financial crisis, while at the same time interest rates have fallen to zero or even below. The difficulty with 'seasons' lies in determining when a new one begins. Are the interest rates on 10-year bonds that have risen in recent weeks already the harbinger of a change of season or simply a rain shower in the middle of summer? The assignment to the quadrants does not correspond to the effectively measured value of growth or interest rates, but to the market participants' expectations about the future development of these two factors.

Conclusion

Awareness of the four different market environments helps investors to assess and explain current movements in the financial markets. In particular, it guards against assuming a simple continuation of the past. If shares and bonds were attractive in the last 30 years due to fundamentally falling interest rates, this need not apply equally to the next 30 years. However, one should be cautious about trying to predict exactly when the regimes will change.