Knowledge: Assets in a stress test – an assessment after the first half of the year

The effects of the corona pandemic have dominated the financial markets in the first half of 2020. The first half of the year was characterised by high volatility. First, asset valuations fell rapidly, only to rise sharply again almost immediately. With the end of the second quarter we can make an initial assessment of how asset managers have performed in this environment. Two findings stand out: many have been too hesitant in rebalancing and most continue to focus on traditional stocks and invest little in new technology. (pm)

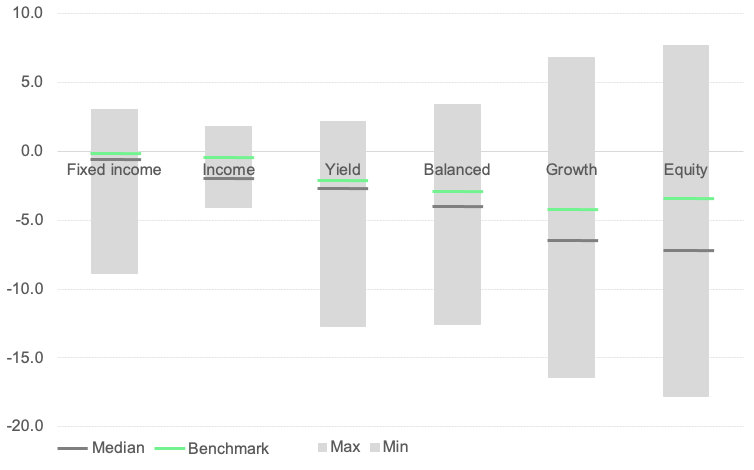

Graph 1: Fixed income investment strategy (% equity quota) / income (15%) / return (25%) / balanced (50%) / growth (70%) / shares (95%)

In 2019, all asset classes were still performing well across the board. There was little reason for investors to be dissatisfied. The current situation is different. Valuations are fluctuating very strongly and an assessment of the impact of the corona crisis does not yet seem to be complete. This makes it all the more important to be able to correctly assess the performance of your own asset manager. The analysis for the first half of the year provides the opportunity to make a simple comparison of one's own portfolio with the results in the market.

The top managers are holding their own even in a difficult environment. With the right manager selection, investors have achieved almost three times the return since 2010.

Patrick Müller, CEO ZWEI Wealth

The range of results in the individual risk categories remains high. For a balanced risk profile, the median result is -4.4%. This value is slightly below the result of the purely passive benchmark. Chart 1 shows the results for all risk groups, always comparing the median result of asset managers and banks versus a purely passive solution, between the beginning of the year and the end of June 2020. The analysis allows investors to make a rough assessment of their portfolio.

Rebalancing seems to be a rare skill

What is noticeable is that the gap between the median and the benchmark increases as the proportion of equities increases. If you look at the results in detail, the rebalancing aspect stands out. With such large fluctuations as those seen in mid-March, a well-established rebalancing process makes a big difference. The positive effect of rebalancing is basically confirmed in the literature and is also propagated by most asset managers (also as a selling point). However, this does not seem to be implemented very well in reality. Anyone who has not practised rebalancing properly has lost between 1-2 p.p. in returns this year. The qualitative part of the analysis also suggests that many asset managers prefer to trust traditional stocks such as Nestlé, Novartis, etc. and tend to underweight technology stocks.

Top managers also cope better during the crisis

For the past five years, ZWEI Wealth has maintained a selection of top managers as a reference. This is a one-time selection of 4-7 asset managers per risk category, which were evaluated using the ZWEI methodology. The comparison (see chart 2 on the right) shows that the good managers can be distinguished from the poorer ones. In the course of the corona crisis, the difference significantly increased further. Overall, the top managers have withstood the crisis much better.

About the analysis

ZWEI Wealth continuously analyses the results of a large number of asset managers and banks in various risk categories. In doing so, the most common strategies of the largest providers as well as mandate portfolios in the Swiss market are taken into account.

Explanations

Median/Maximum/Minimum: Median or maximum or minimum value of the survey in the respective risk category

Benchmark: A simple, investable and therefore replicable passive portfolio consisting of a few building blocks (global equities, Swiss equities, global bonds, Swiss bonds) in various risk categories