The annual performance comparison for asset managers

Every year, ZWEI Wealth conducts a performance comparison of asset managers. This year, over 100 banks and asset managers took part in the benchmarking. Overall, the results achieved can be considered good, not only in absolute terms, but also in relative terms. Investors can use the analysis to compare the returns of their investment portfolios and to search for the most suitable manager.

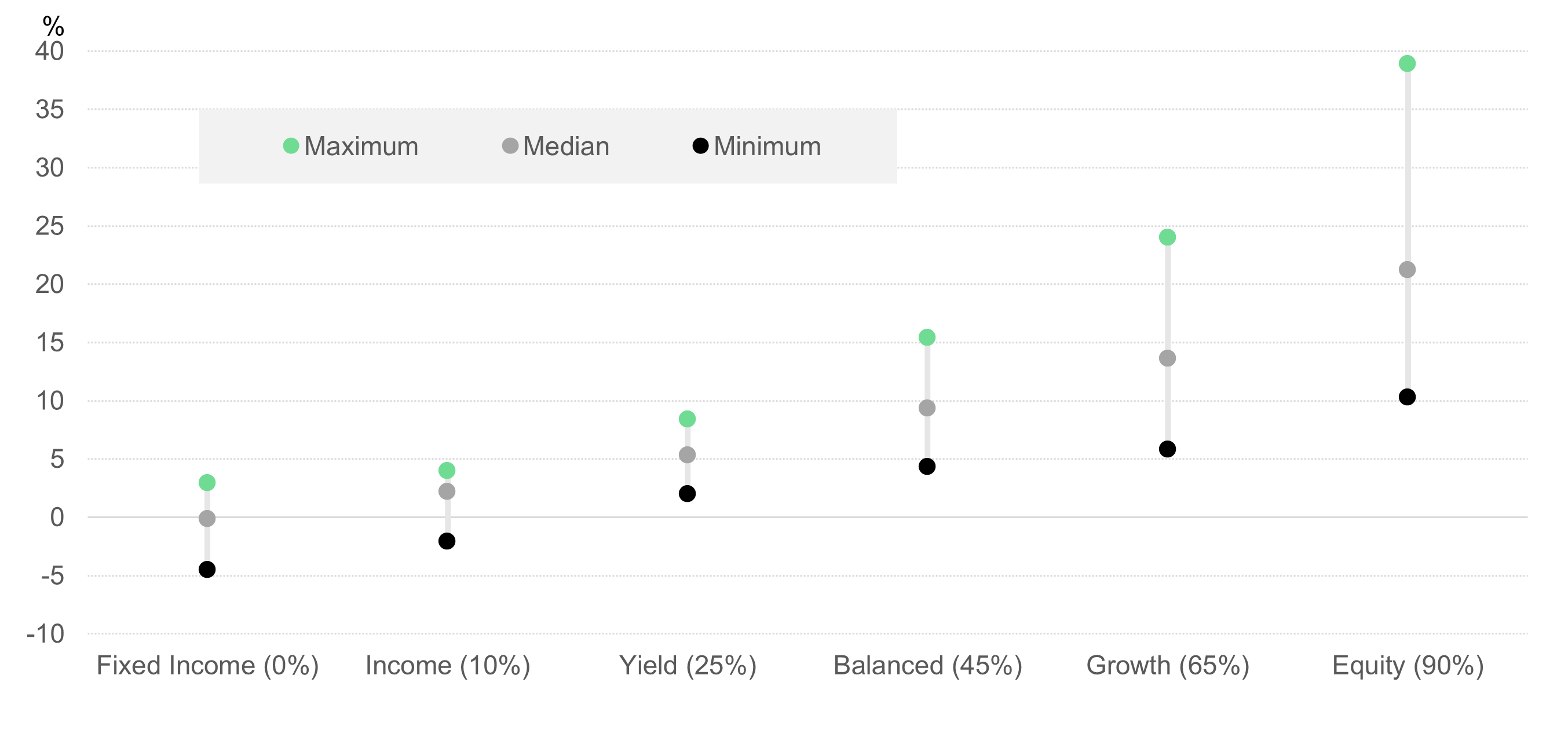

Graph 1: Distribution of returns in 2021 by risk category, Swiss franc (figures in %)

This is the seventh time ZWEI Wealth has compared the annual returns achieved by banks and asset managers. This year, more than 100 providers of asset management services took part in the comparison.

Returns ranging from -5% to +39%

The differences in the returns of asset management companies were significant in 2021. The best investment portfolios achieved returns of +39%, the worst stood at almost -5%. Once again, asset managers with a high proportion of equities achieved returns considerably better than conservative portfolios with a high proportion of bonds. But even within similar risk groups there are big differences. The worst asset manager in the equities category achieved a return of just under +10%, while the best achieved almost four times as much, at close to +40%.

Bravo - many asset managers did a lot right in 2021. The added value of active management was greatest in conservative investment portfolios. But even with riskier investment strategies, many were able to beat the benchmark.

Patrick Müller, CEO ZWEI Wealth

The most important results at a glance:

- Few negative returns: Thanks to strongly rising financial markets, it was easy to generate a positive return overall. Only asset management companies holding a lot of bonds faced a more difficult task.

- Differences remain very large: As is the case every year, there is a considerable dispersion of results in all risk profiles. The difference between the top quartile and the lowest quartile increases with a higher share of equities. In 2021, the gap is roughly in line with the historical average. The return difference across all risk profiles is 12.5 percentage points on average over many years. In 2021, this value comes to 12.9 percentage points.

- Advantages of active management in conservative portfolios: The comparison of active and index-oriented asset management in each case provides information on how much added value the asset managers can achieve compared to the general market. In 2021, the actively managed investment portfolios clearly outperform index-oriented portfolios, especially in the case of conservative investment strategies. For portfolios with a higher share of equities, the actively and index-oriented portfolios are on average on an equal footing.

- Top managers prove their worth: In 2021, it is once again confirmed that asset managers with a long track record and a clear investment philosophy (referred to as top managers at ZWEI Wealth) regularly achieve better results. More than 70% of the top managers are also to be found in the top third in 2021.

How can investors benefit from the analysis?

The complete analysis will be published in March as a transparency report and can be ordered free of charge. Simply send us an email: info(at)zwei-we.ch. Clients can further request this analysis and comparison from their bank or asset manager directly.

All participating asset managers and banks receive an evaluation of their results in a competitive comparison - free of charge

The difference between a good and a bad asset manager? The good asset manager does not shy away from comparison!

Thomas Herrmann, Partner ZWEI

Important remarks: Portfolio assessment should be more comprehensive

In order to obtain a more reliable statement about the quality of asset management, a longer period of time must be analysed and the exact approach (type of implementation, added value compared to specific benchmarks, costs, etc.) must be taken into account. ZWEI Wealth offers advisory services for this purpose so that every investor can draw the right conclusions for themselves.

We would like to thank all participating banks and asset managers for their cooperative and constructive collaboration.

Further details on which providers have been checked can be found here - or be requested directly from us: info(at)zwei-we.ch.