85 banks and asset managers received their performance comparison

What is the difference between a good and a bad wealth manager? The good wealth manager is not afraid of comparisons! ZWEI Wealth's annual performance analysis gives banks and asset managers the opportunity to compare their results. All banks and asset managers received their 2019 performance comparison report yesterday. Investors can now request this report from their bank or asset manager.

USD portfolio results

Since 5 years, ZWEI Wealth is organising the annual performance comparison for banks and asset managers. Again, 85 asset management providers participated and submitted their gross returns.

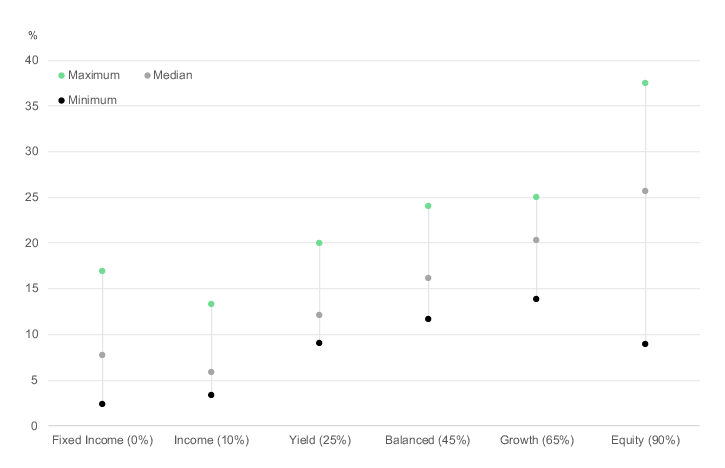

The most important results at a glance (CHF portfolio results):

- Absolutely positive returns in all risk profiles: All risk profiles achieved a positive absolute return in 2019. The mean value (median) of a balanced risk profile achieved a return of around 14%.

- Added value through active managers: In the context of very strong financial markets 2019, the active managers examined by ZWEI Wealth were able to keep up with passive solutions (comparable risk), or to exceed them on average. In almost all risk profiles, the median of the results in 2019 is close to or slightly above the investable benchmarks. In 2018, the middle field of banks and asset managers was significantly below the passive benchmark. Relevant costs have already been taken into account.

- As in previous years, there was a significant spread of results in 2019. The mean deviation between the best value and the lowest is around 8 percentage points across all risk profiles. The difference for stocks is almost 29 percentage points. Some providers were able to generate (significant) added value with comparable risks, but some also performed comparatively poorly in 2019.

Good wealth managers are not afraid of the comparison. On the contrary, it makes them better.

Thomas Herrmann

Head Provider Management, ZWEI Wealth

Added value 1: Providers get a comparison option

It is difficult for banks and asset managers to compare their own results with others. ZWEI gives the providers the opportunity to make a comparison to real portfolios. Every bank and every asset manager who takes part in the analysis is sent its own performance comparison free of charge. In addition, ZWEI Wealth is available for direct feedback to the administrators in order to improve the services overall.

Added value 2: Customers can request the report from their provider

ZWEI Wealth does not publish details on individual providers. After all, it's about promoting dialogue and exchange. However, since all participating banks and asset managers receive a detailed evaluation, customers are welcome to ask their bank or asset manager directly. If the comparison does not yet exist, clients can also ask their bank or asset manager to have it created by ZWEI Wealth (free of charge). ZWEI also offers interested customers the opportunity to subject their specific portfolios to this direct market comparison without involving their bank or their manager (second opinion).

About the analysis

ZWEI Wealth conducts a performance survey every year at over 300 banks and asset managers. 85 providers participated this year. The performance of the portfolios in 2019, which are usually managed as mandates in segregated accounts, was asked. A distinction is made between six different risk categories, roughly graded according to the average equity component (see below). The data is collected for the following three currencies: Swiss francs, euros and US dollars. ZWEI also uses the data from second opinions if customers have their portfolio checked independently by ZWEI. These also serve to check the information provided by the banks and asset managers.

We thank all participating banks and asset managers for the cooperative and constructive cooperation.

Further details on the results are available via info(at)zwei-we.ch.

Glossary

Median / maximum / minimum

Corresponding values from the results of the survey in the respective risk category.

Passive benchmark

In this context, a simple, investable and therefore replicable passive portfolio (global equities, Swiss equities, global bonds, Swiss bonds).