The simplest remain the best investment strategies

'The investment strategy is the most important part of asset management. That is why we tailor the strategy to your individual needs'. These or similar sentences can be found in almost every asset management brochure. We investigated the question of how well the promises are implemented in reality. The comparison shows that simpler strategies fare better than (overly) complicated ones.

Small differences between providers

When analysing investment strategies, the similarity between providers quickly becomes evident. Regardless of which risk profiles are examined, the differences between the weightings of the asset classes are rather small from one provider to the next. This finding is not new, but it is essential for investors. The phenomenon that investment strategies are so similar is incidentally described in professional circles under the term 'career risk'. This means that it makes more sense for portfolio managers to do the same as everyone else in order

to avoid attracting negative attention.

Simple strategies do better

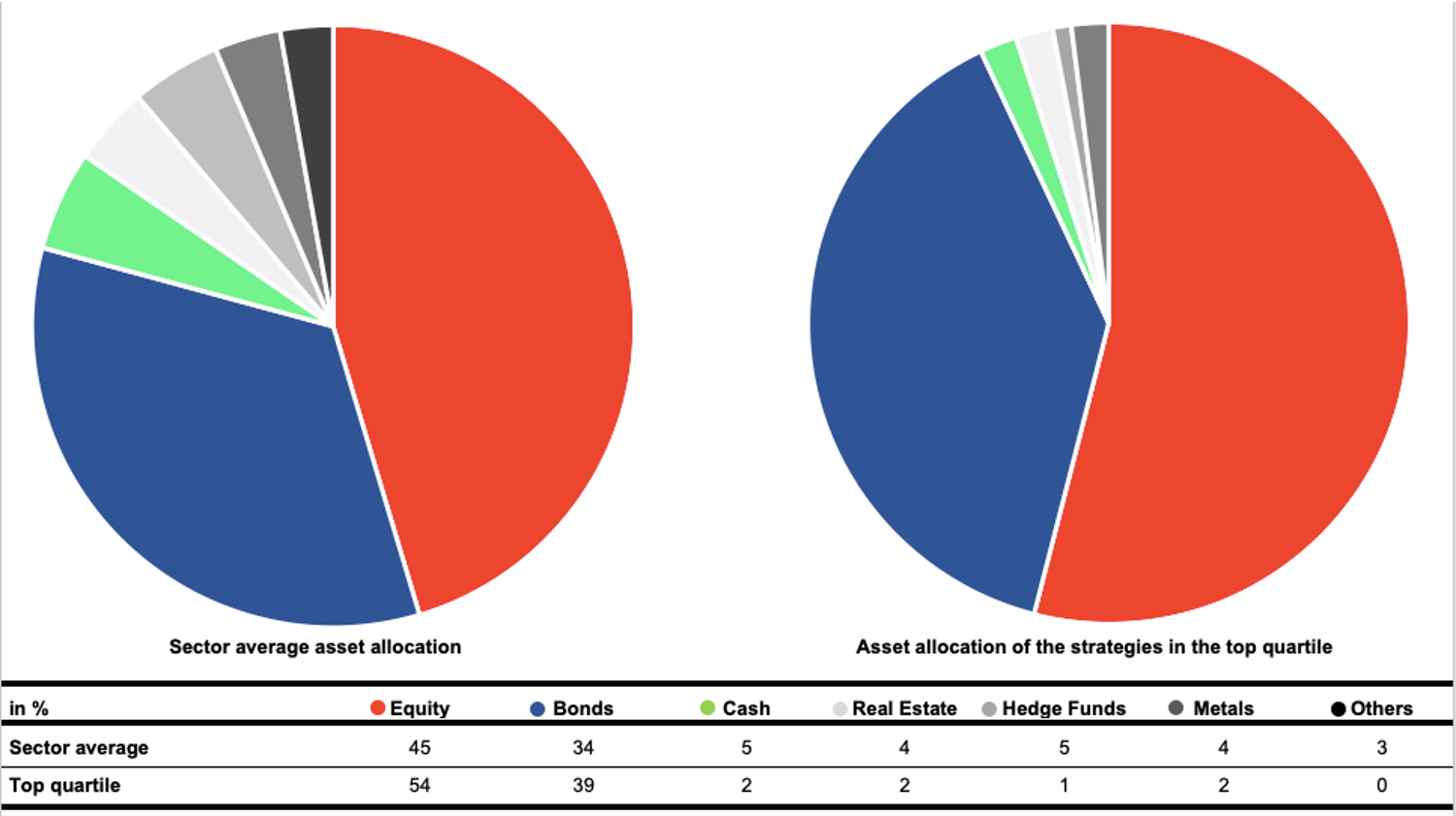

The analysis of the investment strategies nevertheless shows a very interesting difference when the industry average is compared with the top quartile. This analysis shows that the managers with the most successful investment strategies concentrate their portfolios almost exclusively on equities and bonds and invest very little in so-called alternative asset classes.