Portfolio returns in the first half-year 2021

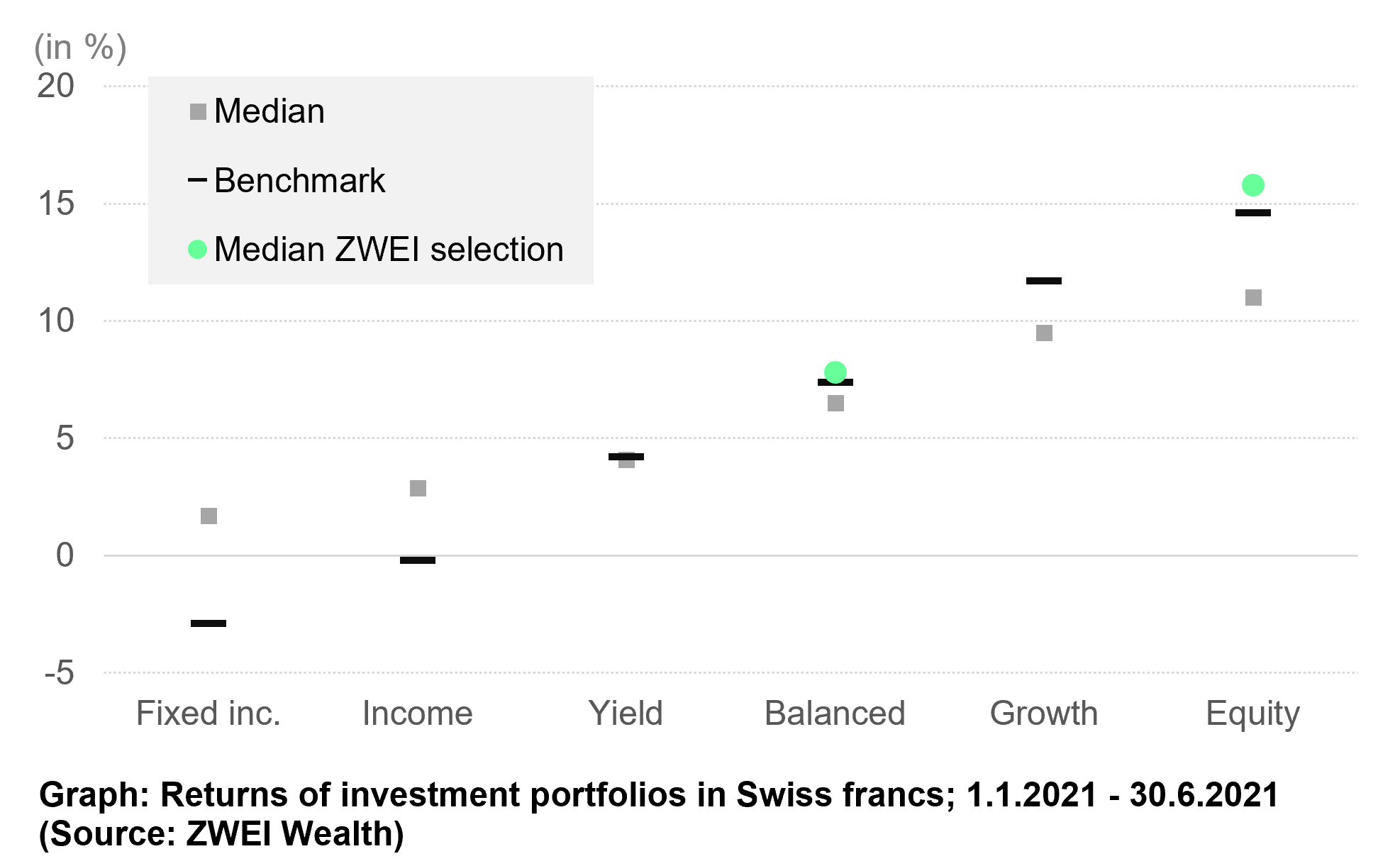

The first half of the year brought a veritable market rally on the equity markets. Swiss franc-denominated investment portfolios achieved a median return of between +1.7% and +11.0%, depending on the risk category. These are values that are far above the long-term average. The contribution of the banks and asset managers to this success is rather mixed. (pm)

Let me say this much in advance - the market environment made it easy for all asset managers to generate returns for their clients. Those who invested a substantial percentage of their assets in equities could hardly go wrong. And yet, the same holds true this year: the difference between the good asset managers and the rest is considerable.

Asset managers: Overall satisfactory performance, shortfalls in more aggressive investment strategies

The evaluation of the results of banks and asset managers also shows large differences in the returns achieved in 2021. The chart summarises the comparisons. The median reflects the average asset manager and the benchmark shows the results of the financial market without the involvement of a manager. It is noticeable that the asset managers succeeded in achieving added value especially in the conservative investment portfolios. Here it was worthwhile to hire a manager. As soon as a larger part of the portfolio was invested in shares, the results of the average asset manager compared worse.

ZWEI Wealth's asset manager selection achieves significantly better returns

It is ZWEI Wealth's aspiration to enable significantly better results for clients through systematic assessment and regular monitoring of asset managers. The chart shows the median ZWEI selection (average manager of the ZWEI Wealth selection) for the most common risk categories Balanced and Equities in the same comparison. In both cases, the ZWEI Wealth selection (see Finding the most suitable wealth manager amongst the best ones) comes out ahead of benchmark and ahead of median. The edge in equities stands out particularly positively.

Conclusion: Even with very good returns, one should compare the results to get a good indication of the performance.

For further information and support, the experts at ZWEI Wealth will be happy to answer your questions.