Over 100 banks and asset managers took part in the 2020 performance comparison

What is the difference between a good and an average asset manager? The good asset manager is not afraid of comparison! Again this year over 100 banks and asset managers took part in the performance comparison for 2020. Investors can use the analysis to compare the returns on their investment portfolios and begin their search for the most suitable manager.

For the sixth time, ZWEI Wealth is comparing the annual returns achieved by banks and asset managers. This year, a record number of over 100 asset management providers took part and faced the comparison.

A very good year for Swiss asset managers

Despite or perhaps because of the pandemic, the majority of asset managers can look back on good to very good results in 2020. In the investment portfolios with balanced and growth-oriented risk profiles, the majority of the managers can report returns that are above a generic benchmark portfolio. This shows that a large part of the administrators knew how to take advantage of the opportunities that arose in the context of the turbulent 2020.

That was actually a year to the liking of active asset managers. Clear action, experience and a steady hand led to above-average success.

Patrick Müller, CEO ZWEI Wealth

The most important results at a glance:

- Good results despite pandemic: Overall, most asset managers and banks closed the 2020 investment year on a positive note despite the pandemic and negative economic effects.

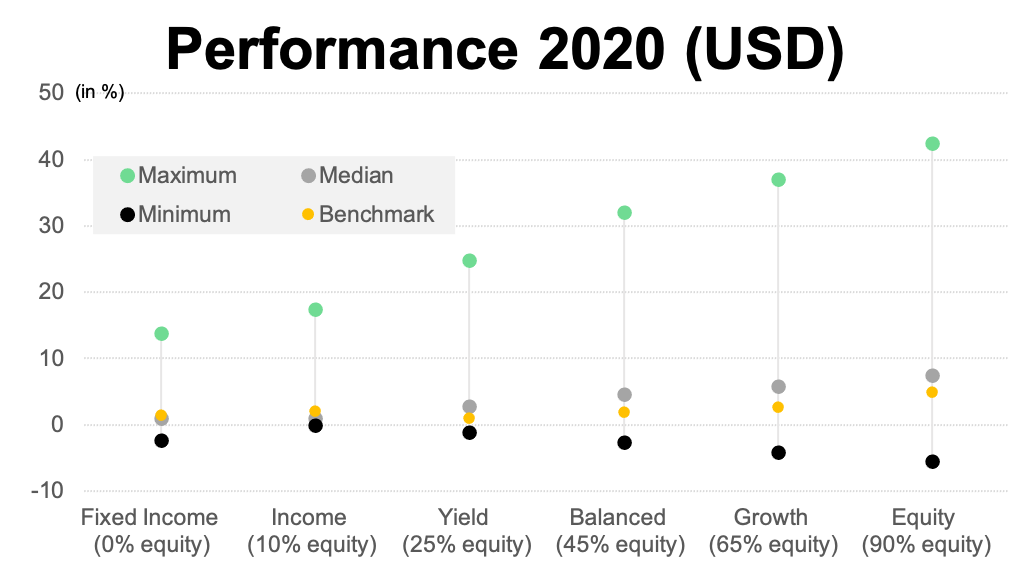

- Larger differences than in other years: As in all years, there is a considerable spread of the results in all risk profiles. The difference between the top quartile and the lowest quartile increases with the proportion of equities. However, the difference in 2020 is significantly greater than in other years. The return difference across all risk profiles has been a long-term average of 12.5 percentage points. In 2020 this value will be 21.6 percentage points.

- Winner formula - systematics and strategy orientation: Maintaining and returning to the strategy during and especially after the strong correction in March has paid off for some administrators. This also explains a significant part of the performance differences. Some administrators were caught on the wrong foot by the rapid and strong recovery and hesitated to rebalance or reorient. Portfolios that quickly rebalanced in the wake of the crisis and had the realignment on technology stocks on their radar for some time did particularly well.

- Classic asset classes continue to do better: The asset managers who concentrated their portfolios on the classic asset classes of bonds, stocks and maybe even gold performed better than those who were looking for diversification in hedge funds, commodities, structured securitisations, etc.

How can investors benefit from the analysis?

- The entire analysis will appear as a transparency report at the end of January and can be ordered here free of charge

- All participating asset managers and banks receive an evaluation of their results in a competitive comparison - free of charge. Customers can request this analysis and comparison from their bank or their asset manager themselves.

- Investors can have an individualized benchmark check (CHF 250) created for their investment portfolio based on the analysis data (here) or search for the best asset manager for themselves with a tender

Transparency and comparability promote competition and thus contribute to a higher quality of services in asset management.

Thomas Herrmann, Partner ZWEI Wealth

Important Notes: Portfolio assessment should be more comprehensive

In order to obtain a more reliable statement about the quality of the asset management, a longer period of time must be analyzed and the exact approach (type of implementation, added value compared to specific benchmarks, costs, etc.) must be taken into account. ZWEI Wealth offers advisory services so that every investor can draw the right conclusions for themselves.

We would like to thank all participating banks and asset managers for their constructive partnership.